Annual percentage rate (APR) is determined based on your credit score, the amount you wish to borrow and your steady income. Generally, a good CIBIL score calls for a low APR while a poor CIBIL score means high APR. But we have a fixed APR which is the same for all.

APR reflects the true cost of borrowing money. It includes the annual interest rate, a nominal processing fee and other miscellaneous expenses. APR is usually lower than your credit card interest rate. APR is the actual annual cost of your loan that helps you compare various loan offers from different lenders. We have a fixed APR @ 33.6% per annum.

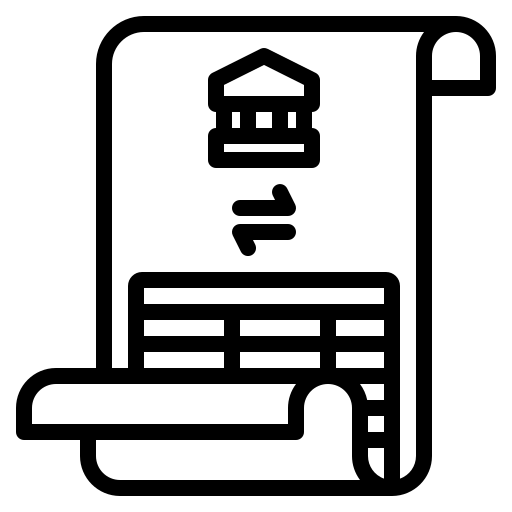

| Tenure | Loan Amount | Interest Rate | Admin Fees | Amount disbursed | EMI | Total Interest |

| 12 Months | Rs.100000 | 2% | Rs.1000 | Rs. 99000 | Rs. 9456 | Rs.13472 |

You must be sure about the eligibility criteria while applying for an Instant Loan online, and it depends on various factors such as income and creditworthiness of the customers, age, nationality and residential status of the customers are also essential, so the factors affecting the eligibility criteria are as follows

To be eligible for our Instant Loan, you must be at least 18 years old and a legal resident or citizen of the country where the loan is offered. You’ll need to provide proof of steady income, whether from employment, self-employment, or other sources, to demonstrate your ability to repay the loan. An active bank account for fund disbursement and repayment is required, along with valid government-issued identification. While we consider your credit score, we are flexible and work with you to find the best solution for your emergency needs.

Documents required for the loan application depend on the types of employment such as self-employed or salaried persons. However, the main documents are the same, especially for the identity and residential status. The income proof can be different. So the documents required for an online Instant Loan are as follows.